As the old saying goes, when you’ve been to one telecom conference, you’ve been to them all.

Well, okay, maybe that’s not really an old saying (I just made it up), but the sentiment holds. They usually are very much the same: economists quoting irrelevant numbers, idealogues spouting ideologies and company executives lobbying their various positions.

The organizers of the International Institute of Communications’ annual conference in Ottawa, however, deserve much credit for trying to spice things up by bringing in some outsiders. I thoroughly enjoyed a morning panel session on Monday about industry competitiveness that featured some sparring between University of Calgary economist Jeffrey Church and Carleton journalism professor Dwayne Winseck. At one point, Winseck suggested that Church had called him a “commie and a baby killer,” so yeah, it was entertaining.

My own panel on facts and myth in the industry was fun too, I thought, although nowhere near as colourful. Scotiabank and Genuity analysts Jeff Fan and Dvai Ghose respectively took their turns delving into what they thought were some of the myths circulating out there, while telecom consultant Gerry Wall reiterated the need for doubt in a business aflood with differing numbers and viewpoints.

For my part, I chose to focus on two myths, which should be familiar to regular readers. Here are the speaking notes (and charts) I used during my presentation:

***

We’re here to talk about facts and myths in the telecom industry, which is good. I’ve been writing about this industry for nine years now, both here and abroad, and one thing I’ve noticed is it’s a business that seems to revolve around myths.

If it’s not the companies themselves trying to muddy the waters on issues such as pricing, speeds or competitiveness, it’s their employees – both direct and indirect.

The end goal is obvious. The less clarity there is around the industry and its practices, the less likely it is for regulators and governments to get involved, which means the gravy train gets to keep rolling. I have to apologize for using the term gravy train, but I am from Toronto.

My favourite quote on this topic came in 2006 when I was covering Telecom New Zealand, that tiny country’s incumbent phone company. With a bravado that could only be rivaled by Rob Ford, CEO Teresa Gattung told an investor conference the following:

Think about pricing. What has every telco in the world done in the past? It’s used confusion as its chief marketing tool. And that’s fine. You could argue that that’s how all of us keep calling prices up and get those revenues, high-margin businesses, keep them going for a lot longer than would have been the case. But at some level, whether they consciously articulate or not, customers know that’s what the game has been. They know we’re not being straight up.

It was pretty explosive. It was also the final straw for the New Zealand government, which cracked down on the company, eventually forcing it to split itself up, while Gattung was out of her job in short order.

We’ve seen a lot of this “confusion as a marketing tool” lately – who can forget the newspaper ads in which the poor people of New Brunswick were facing the loss of wireless services should Verizon come into Canada?

As such, there are many myths we could talk about. Since we don’t have much time, I’m going to keep it two.

The biggest one – the one that pretty much all of the recent turmoil has been based on – is whether wireless prices in Canada are high. To put it in the most simple terms possible, yes they are. The proof is reflected in Canadian carriers having the highest average revenue per user in the world. This ARPU, as it’s known, reflects the size of the average customer’s bill at the end of the month.

Yet the companies and their supporters have argued that prices aren’t high. That world-leading ARPU is actually the product of Canadians being among the heaviest users of wireless services. When you use something a lot, of course your bill is going to be big. If you drive a lot, for example, you’re going to spend more on gas than the guy who doesn’t.

This is more confusion at work, as my first slide shows.

If there’s one thing we can all agree on, most wireless carriers in the world are now firmly in the midst of a shift to where data usage is the primary factor on which monthly plans are being sold. Voice minutes, texts, all that other stuff are now secondary add-ons.

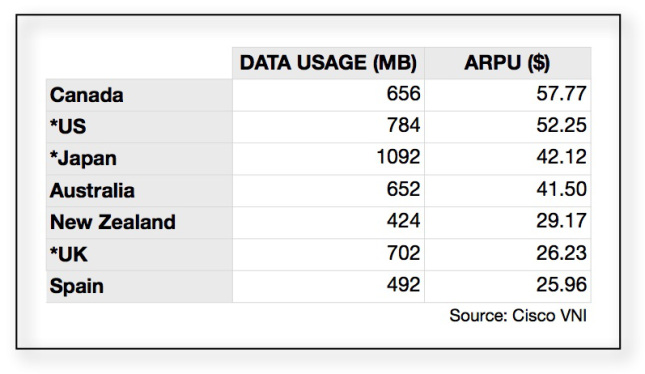

The first chart shows the seven heaviest users of mobile data in the world, according to Cisco’s Visual Networking Index. I’ve ranked them in descending order of ARPU. (Note: asterisks are for countries that exceed Canada’s usage.)

Canadians are actually the fourth heaviest users, but their bills are the highest. The differences between comparable countries are fairly staggering though – customers in the UK, for example, use more data than Canadians yet have bills that are half the size.

The interesting part of the claim that high usage is what’s causing high bills is the fact – not myth – that mobile data usage is on the rise everywhere in the world. In fact, mobile data usage grew 70% globally in 2012 and will continue to grow by 66% every year till at least 2017, according to Cisco.

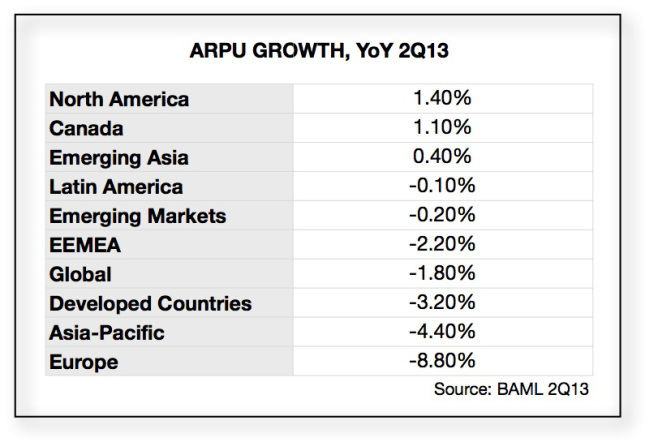

However, as the second chart on the bottom left shows, something interesting is happening with customers’ bills: they’re going down almost everywhere in the world. Except, of course, in Canada and the United States (plus a recent slight uptick in emerging Asia).

This is where the industry’s arguments that high ARPU does not equal high prices and is instead a reflection of heavy usage don’t seem to stack up. If usage is going up everywhere, why are bills going down? The simple answer seems to be: prices are going down everywhere too.

One interesting side note – if you look at those seven biggest users of mobile data, you might notice that five of them are English-speaking countries. That does a lot to demystify this notion that Canadians magically love the internet more than people in other countries do. One of the crazier suggestions put forward by the industry is this is because it’s so cheap to use the internet here, and that Canadians could in fact stand to pay even more for it.

It actually has more to do with the non-magical fact that we speak English, or the language that the majority of the internet is in.

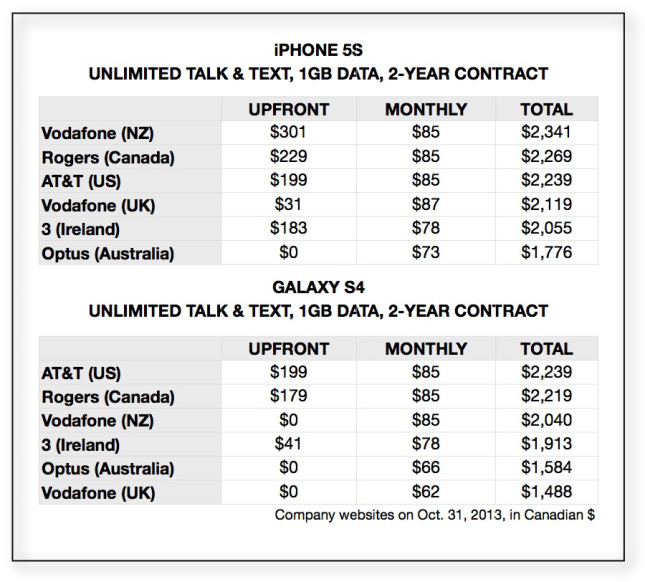

To put all that in context, I did a quick comparison shop for some phones on major carriers in English-speaking countries.

One of the best parts about the CRTC’s de facto ban on three-year contracts is that it’s now much easier to get apples-to-apples comparisons, on pun intended, with other countries. I first shopped for a new iPhone 5S on a two-year contract, with unlimited talk and text and 1 GB of data.

As we can see, Vodafone in New Zealand – where confusion reigns – was the most expensive over the course of that two-year plan, followed by Rogers. Amazingly, Optus in Australia is giving those things away.

Things got more interesting when I compared the slightly older, but still popular Samsung Galaxy S4. As is clear, only AT&T in the US and Rogers in Canada actually charge people for the phone, with everyone else pretty much giving it away. This adds to the cost dramatically.

At Vodafone UK, which is ironically the company that is supplying Rogers with its next CEO, it’s nearly $800 cheaper to own an S4 than it is in Canada.

A few further notes on Canada’s supposedly exceptional smartphone and data usage. As a percentage of the population, our adoption of smartphones is actually below the developed world while our growth is only slightly ahead. Same for the percentage of our monthly bills that is driven by data usage. Ultimately, we’re very average when it comes to adopting and using smartphones.

This all paints a very clear conclusion: high prices do indeed result in high ARPU, which results in high profits. Canadian carriers enjoy a margin of 47.7%, which is third highest in the developed world and 8% higher than the average of those countries.

This is important because high wireless prices don’t just result in grumbling customers – they raise the transactional costs of the economy. Various studies around the world have found that telecom service prices have direct effects on GDP, so high prices effectively make life worse for all of us – except maybe company shareholders and/or direct and indirect employees of the service providers.

In this sense, the government is right to act. We can debate all day what form the government’s intervention should have taken and should take from here on in, but we’ll talk about that later, I’m guessing.

The second myth I’d like to address – and I’ll do so really quickly – is this notion that Canada already has all the wireless providers it needs.

Observers have pointed out that nobody can seemingly survive against the big boys; not Fido or Clearnet, not Mobilicity or Public Mobile – as proof of this. Canada is simply too big a country with too small a population to support more than a pre-destined trio of providers. Or so the argument goes.

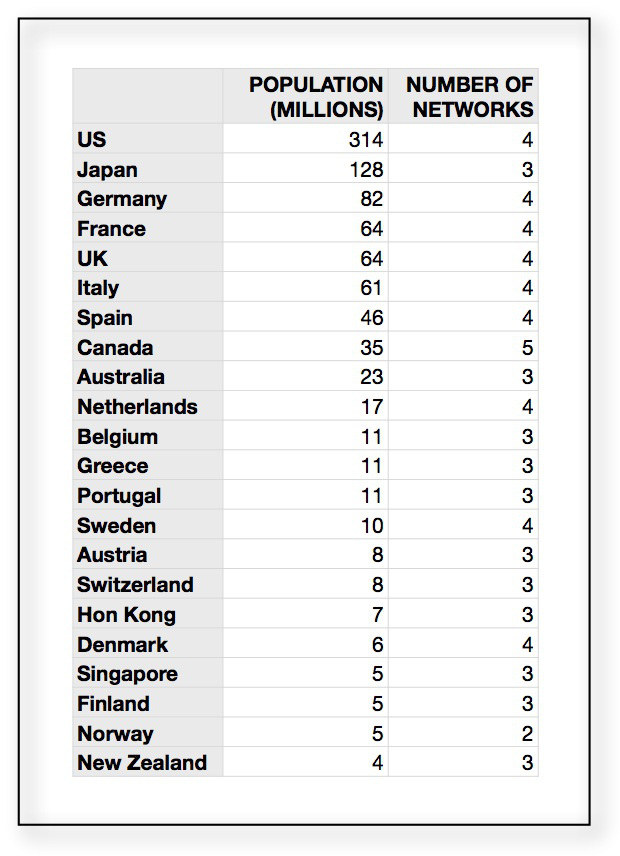

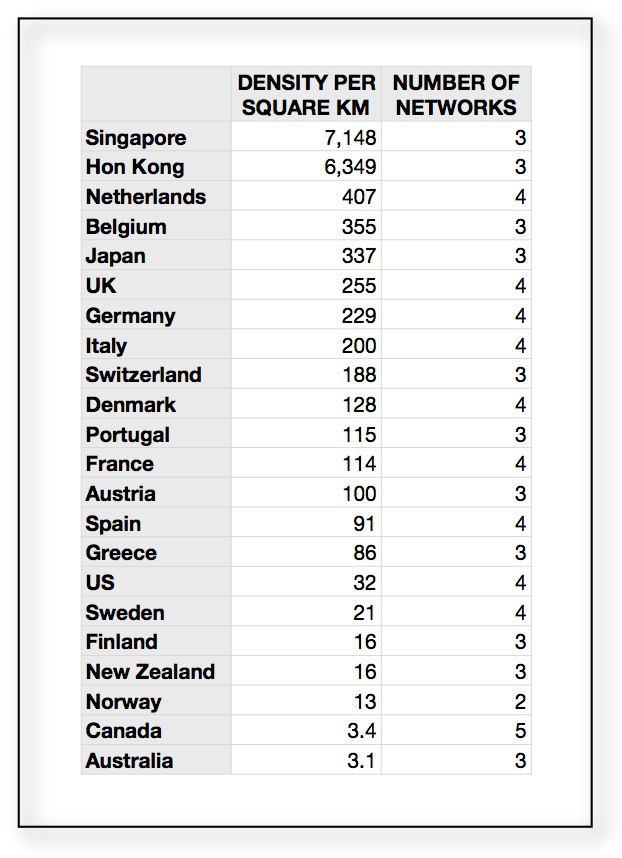

That’s obviously bull. The first chart on the left ranks developed countries by population. As we can see, the US with more than 300 million people has the same number of providers as Denmark, a lovely country of fewer than six million.

Canada is listed as having five, but that’s not really accurate. We probably have closer to 3.5 national providers, and maybe even fewer actual networks, given the wide-scale sharing going on.

Who else has three? You guessed it: New Zealand, land of confusion – where there are 20 sheep for every person - has fewer than four million people.

The point here is: population size doesn’t have much to do with how many wireless providers a country gets. If it did, the U.S. should have 10 times the number of Canada’s.

Similarly, population density doesn’t play into it either. Singapore and Hong Kong are incredibly dense yet they have the same number of carriers as sparsely populated Australia and New Zealand.

Moreover, Canada isn’t actually all that sparsely populated. As we know, 80 per cent of the population lives within a stone’s throw of the US border. If just our nine biggest cities and Southern Ontario are considered, that’s two-thirds of our population or a density that’s right in the middle of the pack.

Ultimately, population and geography have little to do with how much competition there is for telecom services. A country’s individual market conditions – which include government rules and regulations – are the sole determinants.

Why do upstart carriers have it so tough in Canada specifically? The big one is they’ve historically been unable to get foreign funding, which usually demands ownership in return.

But even on the off chance that someone does manage to pool some funds together, they face an incredible number of obstacles. I’ve listed 10 – I won’t go through them since they’re pretty obvious.

So, to put this all together: prices are high in Canada and that’s hurting the economy. New competition would be a great solution to the problem, but that competition faces huge obstacles even if it manages to get off the ground.

The government, even though its approach has been highly debatable, has been absolutely right in trying to correct the issue. It is rightly trying to address the fact – not myth – that Canada has a competition problem when it comes to essential telecommunications services.

jvanl

November 19, 2013 at 2:02 am

Canada’s competition problem is really a complacency problem.

Unless we consumers are ready to take action in our own best interests, we get the government and industry we deserve.

Many American communities are taking action:

http://www.muninetworks.org

http://www.ftthcouncil.org

http://www.bbcmag.com

http://www.ilsr.org

A few Canadian communities are taking action, but not nearly enough:

http://www.o-net.ca

http://www.qnetbc.ca

http://www.rhyzome.net

tomundone

November 19, 2013 at 11:47 am

Thank you for that quote about the use of confusion to keep prices up.

I’ve always felt that that was one of the incumbents primary weapons against their customers. I often find that their C/S reps are confused about all the plans, prices, options, exceptions, deals, etc. and that they make many mistakes. The interesting thing is that the mistakes always benefit Robellus - I guess that is because the computer systems prevent the C/S rep from mistakenly entering anything that is cheaper or better then the real rate, but doesn’t prevent them from entering something different from what the customer wants or needs - which will always disadvantage the customer.

StephenBB81

November 19, 2013 at 12:10 pm

I really enjoyed this article except one thing I didn’t read was margins.

Why is it no one talks about profit margin when they are talking about all of this. I’d like to see Carrier profit margins along side their ARPU’s Who keeps the most of that ARPU?

From my reviews with 2012 numbers Canada while it leads in ARPU does not lead in Margins, US carriers all enjoy greater margins than Canada.

I’d love to see a comparison of all the countries you listed and their carrier margins.